41 10 year treasury bond coupon rate

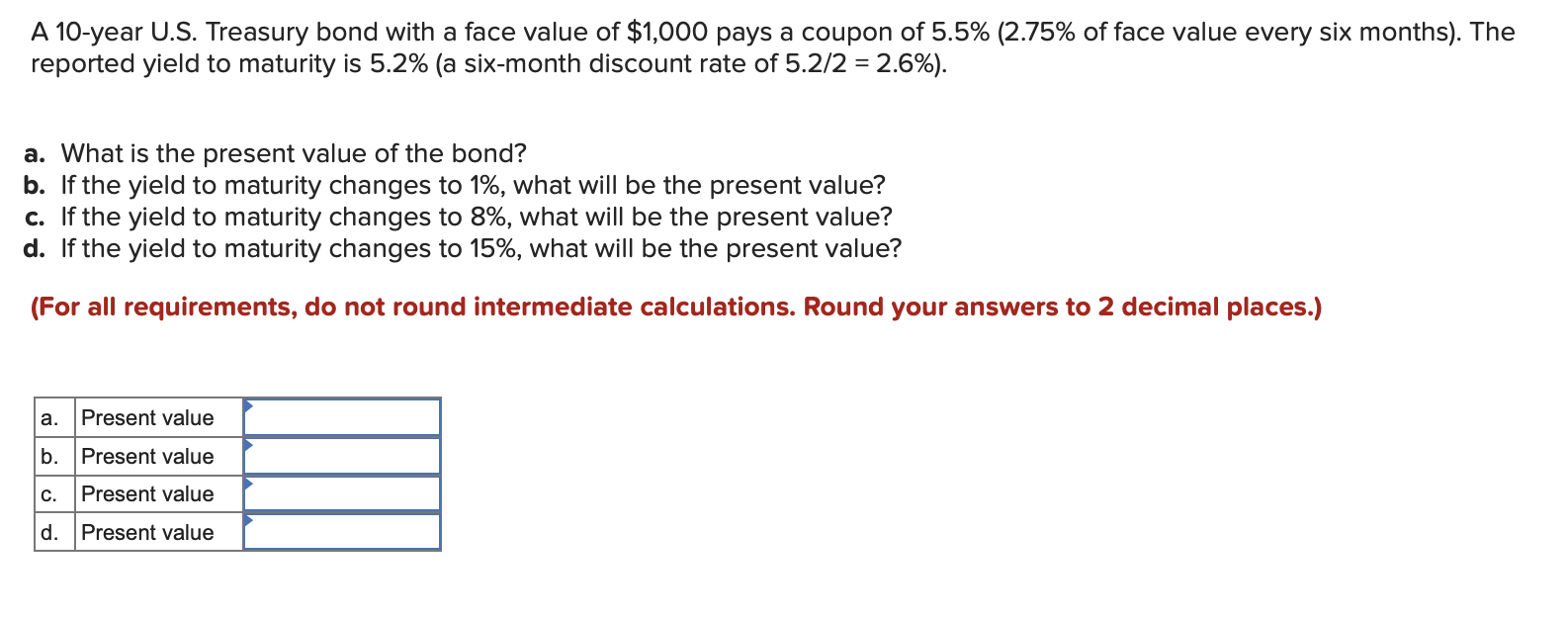

10-Year High Quality Market (HQM) Corporate Bond Spot Rate ... Graph and download economic data for 10-Year High Quality Market (HQM) Corporate Bond Spot Rate (HQMCB10YR) from Jan 1984 to Mar 2022 about 10-year, bonds, corporate, interest rate, interest, rate, and USA. Solved Which security should sell at a greater price? -a ... -a. A 10-year Treasury bond with a 11.25% coupon rate or a 10-year T-bond with a 10.25% coupon. A 10-year Treasury bond with a 11.25% coupon rate O A 10-year T-bond with a 10.25% coupon b. A three-month expiration call option with an exercise price of $40 or a three-month call on the same stock with an exercise price of $45.

Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms . Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest. The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions.)

10 year treasury bond coupon rate

US10Y: U.S. 10 Year Treasury - Stock Price, Quote ... - CNBC Yield Open 2.854% Yield Day High 2.943% Yield Day Low 2.831% Yield Prev Close 2.863% Price 91.0156 Price Change -0.5938 Price Change % -0.6484% Price Prev Close 91.6094 Price Day High 91.875 Price... US 10 year Treasury Bond, chart, prices - FT.com US 10 year Treasury. US10YT. US 10 year Treasury. Yield 2.94. Today's Change 0.052 / 1.82%. 1 Year change +79.88%. Data delayed at least 20 minutes, as of Apr 29 2022 22:05 BST. More . Summary. 10-Year US Treasury Note - Guide, Examples, Importance of ... Treasury notes are issued for a term not exceeding 10 years. The 10-year US Treasury note offers the longest maturity. Other Treasury notes mature in 2, 3, 5, and 7 years. Each of these notes pays interest every six months until maturity. The 10-year Treasury note pays a fixed interest rate that also guides other interest rates in the market.

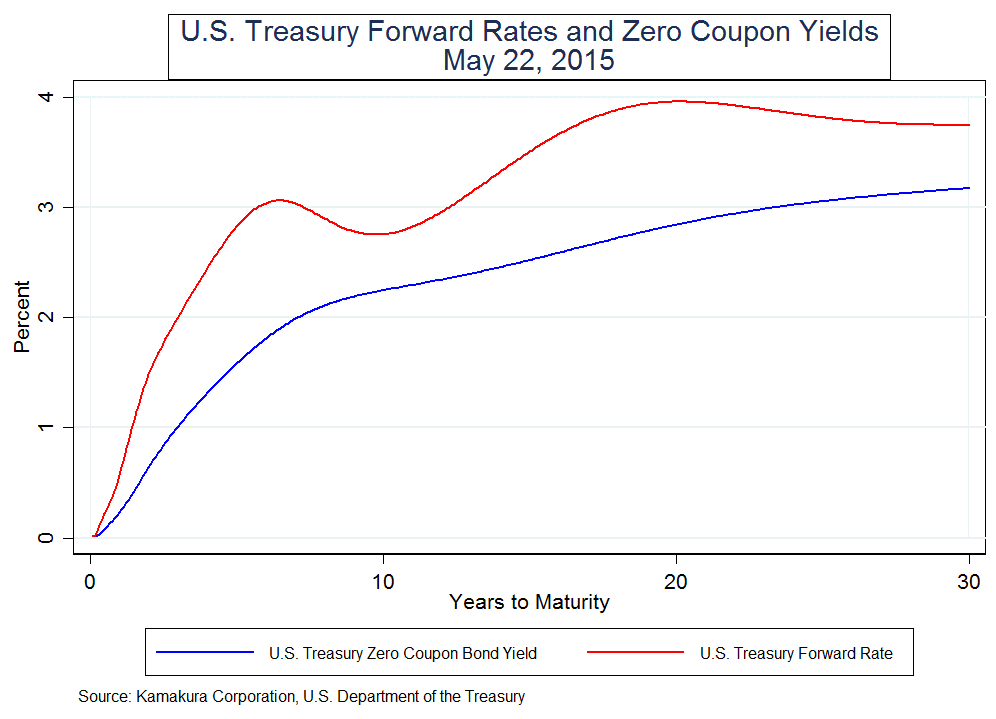

10 year treasury bond coupon rate. How Is the Interest Rate on a Treasury Bond Determined? When investors crave safety, they buy T-bonds. For example, a $10,000 T-bond with a 5% coupon will pay out $500 annually, regardless of what price the bond is trading for in the market. This is... Treasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, Quarterly Average: 2018-Present. TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2012 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2013-2017 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2018-Present. TNC Treasury Yield Curve Par Yields, Monthly Average: 1976-Present US 10 year Treasury Bond, chart, prices - FT.com US 10 year Treasury US10YT US 10 year Treasury Yield2.94 Today's Change0.052 / 1.82% 1 Year change+79.88% Data delayed at least 20 minutes, as of Apr 29 2022 22:05 BST. More Summary Charts More To... Treasury Yield Premiums - Federal Reserve Bank of San ... The 10-year Treasury yield decomposition divides the 10-year zero-coupon nominal Treasury yield into the average expected short rate over the next 10 years and the associated 10-year term risk premium. The unexplained model residual is included in the term premium so that the two components add up to the observed Treasury yield.

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value)... Solved Assume a 10-year Treasury bond has a coupon rate of ... Transcribed image text: Assume a 10-year Treasury bond has a coupon rate of 5.7%. a. Give examples of required rates of return that would make the bond sell at a discount, at a premium, and at par b. If this bond's par value is $10,000, calculate the differing values for this bond given the required rates you choose in part a.< a. TMUBMUSD10Y | U.S. 10 Year Treasury Note Overview ... 10-year Treasury yield down 6 basis points at 2.767% Apr. 26, 2022 at 8:32 a.m. ET by MarketWatch Bond yields tumble as investors sought safety Yield Calculation for a 10-Year Treasury Note | Sapling Current yield simply is the annual interest amount that a bond pays divided by the current price of the bond. For example, if you buy a bond with a $1,000 face value and an interest rate -- also known as the coupon rate -- of three percent, you'll earn $30 per year in interest. Advertisement

10-Year U.S. Treasury Note: Definition, Why It's the Most ... On Aug. 15, the 30-year bond yield closed below 2% for the first time in U.S. financial history. The 10-year note yield rose to 1.93% on Dec. 23, 2019. 10 2020-2021 In 2020, the 10-year yield peaked at 1.88% on Jan. 2 but then began falling. It closed at a record low (at the time) of 1.33% on Feb. 25, 2020. Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10 ... Graph and download economic data for Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) from 1990-01-02 to 2022-04-22 about 10-year, bonds, yield, interest rate, interest, rate, and USA. TMBMKDE-10Y | Germany 10 Year Government Bond Overview ... Open 0.945% Day Range 0.945 - 0.945 52 Week Range -0.520 - 0.982 Price 91 7/32 Change -12/32 Change Percent -0.40% Coupon Rate 0.000% Maturity Feb 15, 2032 Performance Change in Basis Points Yield... TMUBMUSD10Y | U.S. 10 Year Treasury Note Price & News - WSJ U.S. 10 Year Treasury Note TMUBMUSD10Y (Tullett Prebon) 5:01 PM EDT 04/29/22 Yield 2.889% 0.124 Price 91 0/32 1/32 (0.05%) 1 Day Range 2.934 - 2.934 52 Week Range (Yield) 1.132 - 2.978 (08/04/21 -...

United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month . ... Muni Bonds 10 Year Yield . 2.68% +0 ...

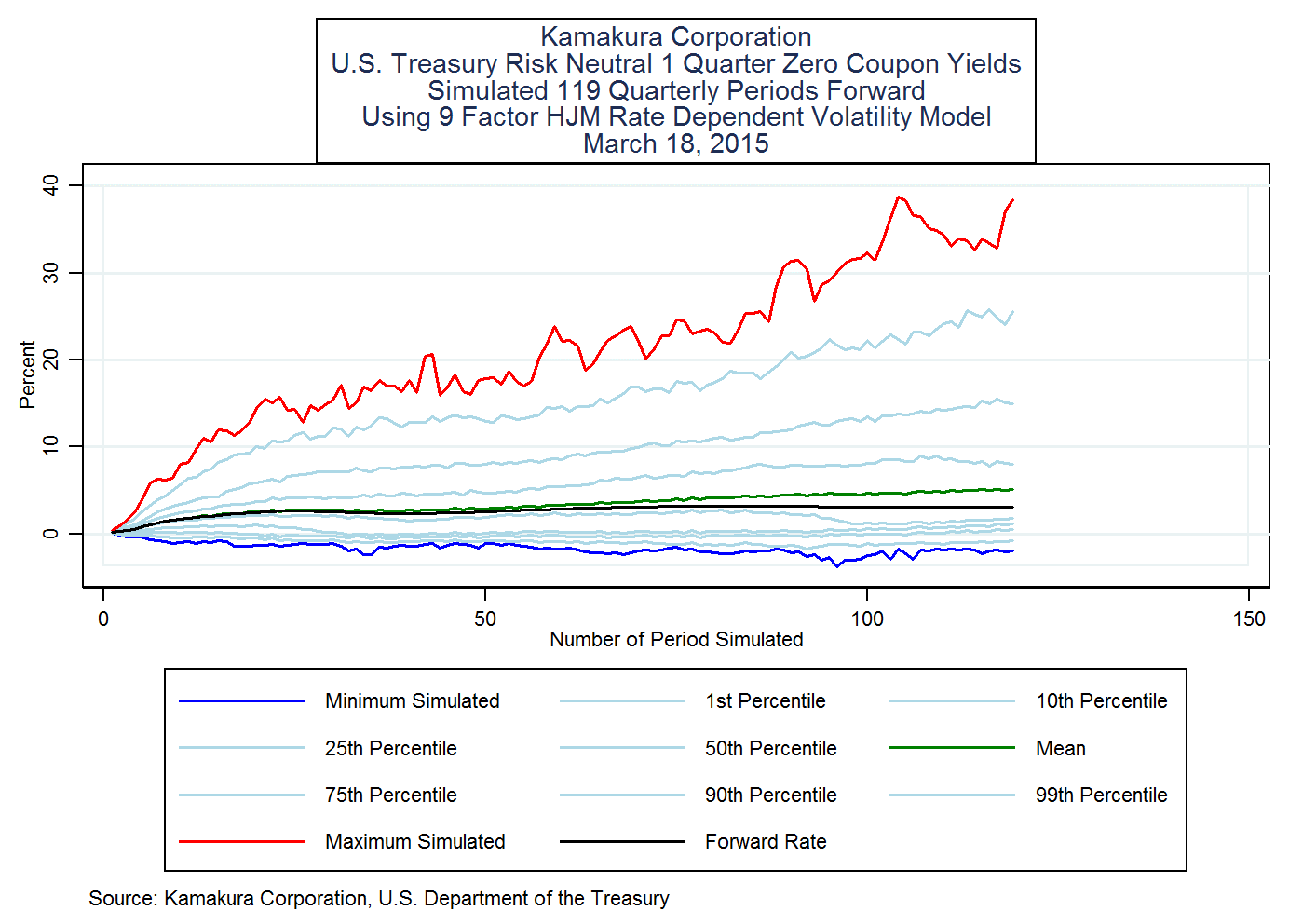

1,000 More Scenarios For The U.S. Treasury Curve Show 3-Month Treasury Bill Rate Rising From 0 ...

Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data. View the ...

Treasury Bond (T-Bond) - Overview, Mechanics, Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

3. (20 points) Assume a 10-year Treasury bond has a ... 3. (20 points) Assume a 10-year Treasury bond has a coupon rate of 2.2 % and par value of $1000. The selling price is $ 1170. A. Calculate and explain how much in dollars you will have on an annual basis, year by year, during years 1 through 10. Year 1; Year 2; Year 3..... Year 9 and Year 10 B. Calculate total dollar income received from this bod

TMUBMUSD30Y | U.S. 30 Year Treasury Bond Overview ... Benchmark 10-year Treasury yield climbs to highest since 2018 as investors price in possible half-point rate hike by Fed in May Apr. 14, 2022 at 3:48 p.m. ET by William Watts

10-Year Treasury Notes Gain On Strong Auction Demand | Stock News & Stock Market Analysis - IBD

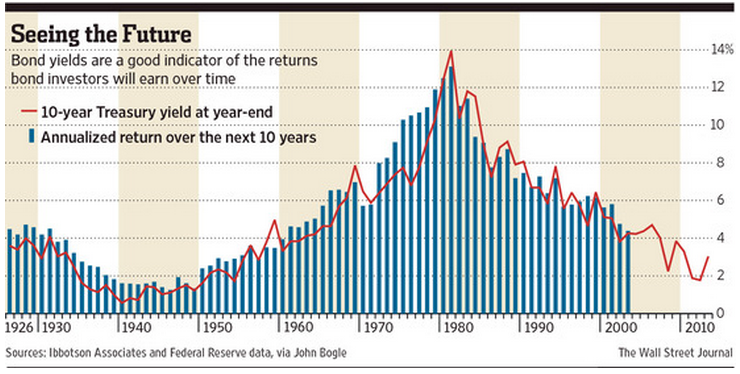

10-Year Treasury Note Definition - Investopedia Below is a chart of the 10-year Treasury yield from March 2019 to March 2020. Over that span, the yield steadily declined with expectations that the Federal Reserve would maintain low interest...

10 Year Treasury Rate - multpl.com 10 Year Treasury Rate chart, historic, and current data. Current 10 Year Treasury Rate is 2.82%, a change of +5.00 bps from previous market close.

[Solved] Please see an attachment for details | Course Hero 3. (20 points) Assume a 10-year Treasury bond has a coupon rate of 2.2 % and par value of $1000. The selling price is $ 1170. A. Calculate and explain how much in dollars you will have on an annual basis, year by year, during years 1 through 10.

10 Year Treasury Rate - YCharts Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury Rate is at 2.89%, compared to 2.85% the previous market day and 1.65% last year. This is lower than the long term average of 4.28%. Stats Related Indicators Treasury Yield Curve

10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of April 28, 2022 is 2.85%. Show Recessions Download Historical Data Export Image

US Treasury Bonds - Fidelity Investments Structure: Coupon or no coupon/discount Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months.

10-Year US Treasury Note - Guide, Examples, Importance of ... Treasury notes are issued for a term not exceeding 10 years. The 10-year US Treasury note offers the longest maturity. Other Treasury notes mature in 2, 3, 5, and 7 years. Each of these notes pays interest every six months until maturity. The 10-year Treasury note pays a fixed interest rate that also guides other interest rates in the market.

US 10 year Treasury Bond, chart, prices - FT.com US 10 year Treasury. US10YT. US 10 year Treasury. Yield 2.94. Today's Change 0.052 / 1.82%. 1 Year change +79.88%. Data delayed at least 20 minutes, as of Apr 29 2022 22:05 BST. More . Summary.

US10Y: U.S. 10 Year Treasury - Stock Price, Quote ... - CNBC Yield Open 2.854% Yield Day High 2.943% Yield Day Low 2.831% Yield Prev Close 2.863% Price 91.0156 Price Change -0.5938 Price Change % -0.6484% Price Prev Close 91.6094 Price Day High 91.875 Price...

Post a Comment for "41 10 year treasury bond coupon rate"