42 yield to maturity of coupon bond

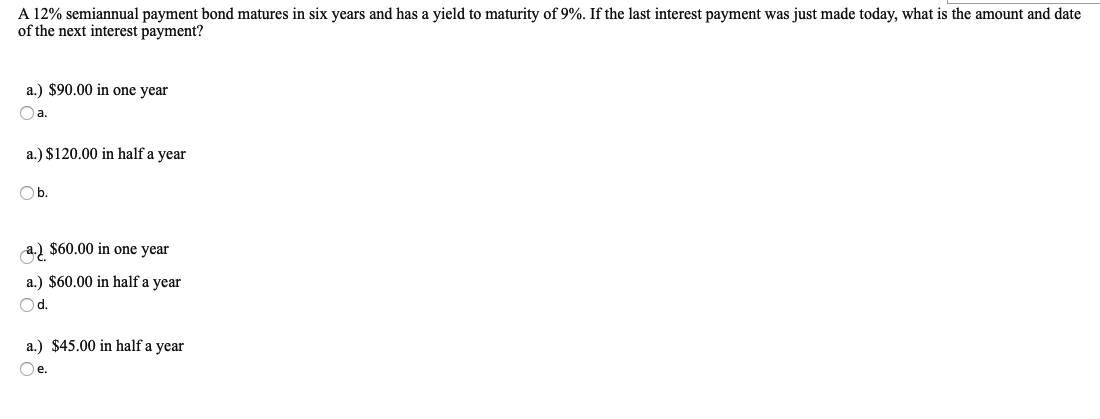

Basics Of Bonds - Maturity, Coupons And Yield Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). Yield to Maturity (YTM) Definition & Example | InvestingAnswers Yield to maturity refers to the return (or yield) that an investor will earn from their investment, which is typically reported as an annual rate. The return is comprised of interest payments (referred to as coupons) and any gain in the bond's market value. The yield is based on the coupon rate the bondissuer agrees to pay.

Important Differences Between Coupon and Yield to Maturity The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

Yield to maturity of coupon bond

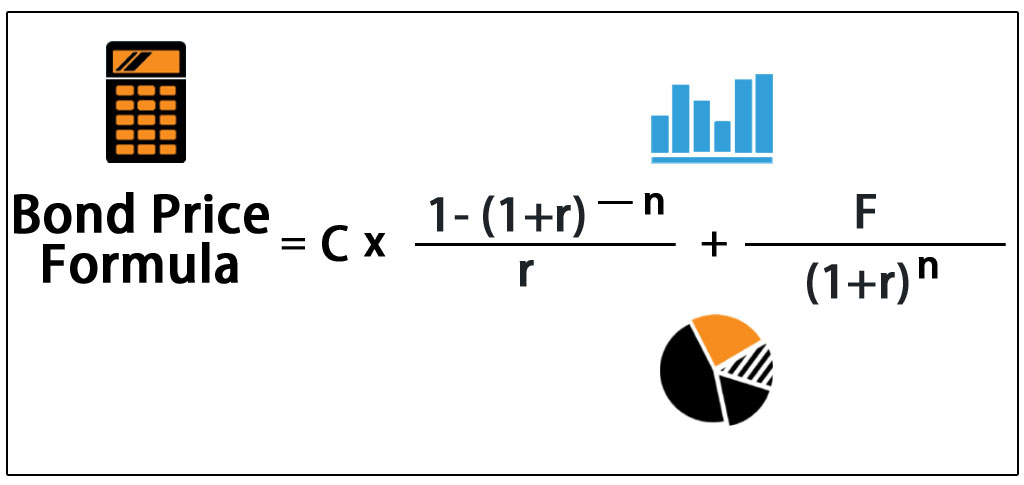

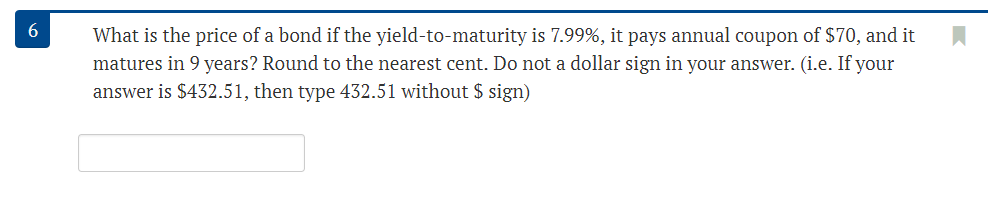

Yield to Maturity | Formula, Examples, Conclusion, Calculator The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%. You can then use this value as the rate (r) in the following formula: C = future cash flows/coupon payments. r = discount rate (the yield to maturity) F = Face value of the bond. n = number of coupon payments. The price of a coupon bond and the yield to maturity A 5 percent coupon bond selling for $ 1,000. The yield to maturity = (face value - price) + interest on face value. The yield is $100, $150, $250, $50 for the given securities respectively. Thus, security number 4 will have lowest yield to maturity. How to Calculate Yield to Maturity: 9 Steps (with Pictures) F = the face value, or the full value of the bond. P = the price the investor paid for the bond. n = the number of years to maturity. 2. Calculate the approximate yield to maturity. Suppose you purchased a $1,000 for $920. The interest is 10 percent, and it will mature in 10 years. The coupon payment is $100 ( ).

Yield to maturity of coupon bond. Yield to Maturity Calculator | Calculate YTM The yield to maturity calculator (YTM calculator) is a handy tool for finding the rate of return that an investor can expect on a bond. As this metric is one of the most significant factors that can impact the bond price, it is essential for an investor to fully understand the YTM definition. ... In our example, Bond A has a coupon rate of 5% ... Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. 1 It is the sum of all of its remaining coupon payments.... Difference Between Coupon Rate and Yield of Maturity 1. The amount paid by the issuer to the bondholder until it's maturity is called coupon rate. The yield of maturity means the total return earned by the investor until it's maturity. 2. The rate of interest is paid annually at a coupon rate. The current Yield defines the rate of return it generates annually. Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

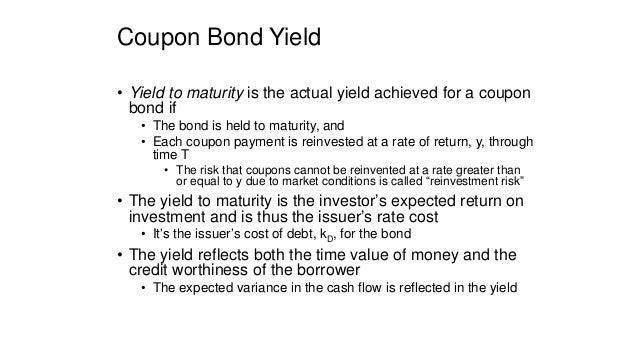

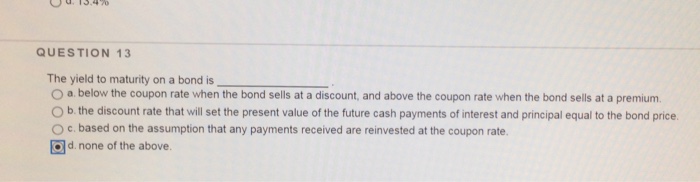

Yield to Maturity (YTM): Formula and Excel Calculator From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made on time and are then reinvested at the same interest rate. In This Article What are the steps to calculating the yield to maturity (YTM) in Excel? Yield to Maturity (YTM) Definition - Investopedia A bond's yield to maturity (YTM) is the internal rate of return required for the present value of all the future cash flows of the bond (face value and coupon payments) to equal the current bond... Solved Question 1 of 71 The yield to maturity on a coupon - Chegg Finance. Finance questions and answers. Question 1 of 71 The yield to maturity on a coupon bond is … · always greater than the coupon rate. · the rate an investor earns if she holds the bond to the maturity date, assuming she can reinvest all coupons at the current yield. · the rate an investor earns if she holds the bond to the maturity ... Yield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ...

Yield to maturity. What is the yield of each of the | Chegg.com What is the yield of the following bond if interest (coupon) is paid monthly? (Round to two decimal places.) Years to Maturity Yield to Maturity 15 Par Value $5,000.00 Coupon Rate 12% Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. What you should know about Bonds? - Learn with Anjali With zero-coupon bonds, the face value at maturity is pre-determined so investors know exactly how much interest income they will receive. ... when the market price of a bond changes. Yield-to-maturity. The yield-to-maturity (YTM) is the annual return an investor earns if the bond is held to maturity. This return is considered a more accurate ... Bond (finance) - Wikipedia In finance, a bond is a type of security under which the issuer owes the holder a debt, and is obliged - depending on the terms - to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time.Interest is usually payable at fixed intervals (semiannual, annual, and less frequently at other periods).

Yield to Maturity (YTM) - Overview, Formula, and Importance Assume that there is a bond on the market priced at $850 and that the bond comes with a face value of $1,000 (a fairly common face value for bonds). On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below:

Yield to Maturity (YTM) - Meaning, Formula & Calculation Using the YTM formula, the required yield to maturity can be determined. 700 = 40/ (1+YTM)^1 + 40/ (1+YTM)^2 + 1000/ (1+YTM)^2 The Yield to Maturity (YTM) of the bond is 24.781% After one year, the YTM of the bond is 24.781% instead of 5.865%. Hence changing market conditions like inflation, interest rate changes, downgrades etc affect the YTM.

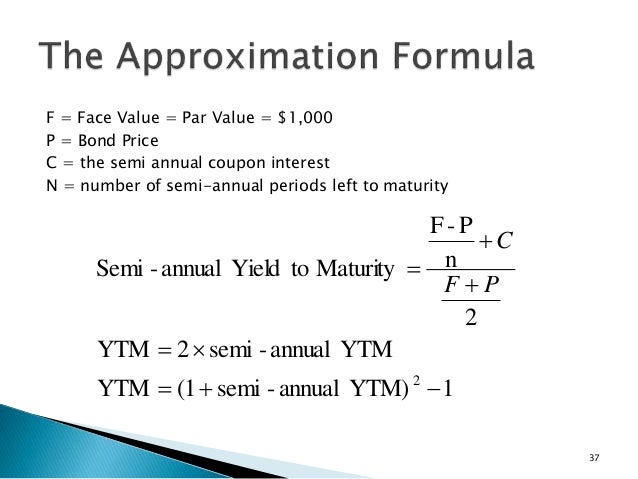

Yield to Maturity (YTM) - Definition, Formula, Calculations Use the below-given data for calculation of yield to maturity. Coupon on the bond will be $1,000 * 7.5% / 2 which is $37.50, since this pays semi-annually. Yield to Maturity (Approx) = ( 37.50 + (1000 - 1101.79) / (20 * 2) )/ ( (1000 + 1101.79) / 2) YTM will be - This is an approximate yield on maturity, which shall be 3.33%, which is semiannual.

Bond Yield Rate vs. Coupon Rate: What's the Difference? If this same bond is purchased for $800, then the current yield becomes 7.5% because the $60 annual coupon payments represent a larger share of the purchase price. Special Considerations A more...

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

Why would two coupon bonds with the same maturity have a different ... If a bond's coupon rate is more than its YTM, then the bond is selling at a premium. If a bond's coupon rate is equal to its YTM, then the bond is selling at par. Formula for yield to maturity: Yield to maturity(YTM) = [(Face value/Bond price)1/Time period ]-1.

Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

How To Easily Estimate A Bond Fund's Expected Returns Yield to maturity is simply the expected annual returns of the bond if held to maturity, meaning income + capital gains. From the above, yield to maturity would equal 0.63% + 2.7% = 3.33%. IEF's ...

How to Calculate Yield to Maturity: 9 Steps (with Pictures) F = the face value, or the full value of the bond. P = the price the investor paid for the bond. n = the number of years to maturity. 2. Calculate the approximate yield to maturity. Suppose you purchased a $1,000 for $920. The interest is 10 percent, and it will mature in 10 years. The coupon payment is $100 ( ).

The price of a coupon bond and the yield to maturity A 5 percent coupon bond selling for $ 1,000. The yield to maturity = (face value - price) + interest on face value. The yield is $100, $150, $250, $50 for the given securities respectively. Thus, security number 4 will have lowest yield to maturity.

Yield to Maturity | Formula, Examples, Conclusion, Calculator The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%. You can then use this value as the rate (r) in the following formula: C = future cash flows/coupon payments. r = discount rate (the yield to maturity) F = Face value of the bond. n = number of coupon payments.

:max_bytes(150000):strip_icc()/the-difference-between-stocks-and-bonds-417069-final-5bbd17bd46e0fb00268fdc8c.png)

Post a Comment for "42 yield to maturity of coupon bond"