44 risk of zero coupon bonds

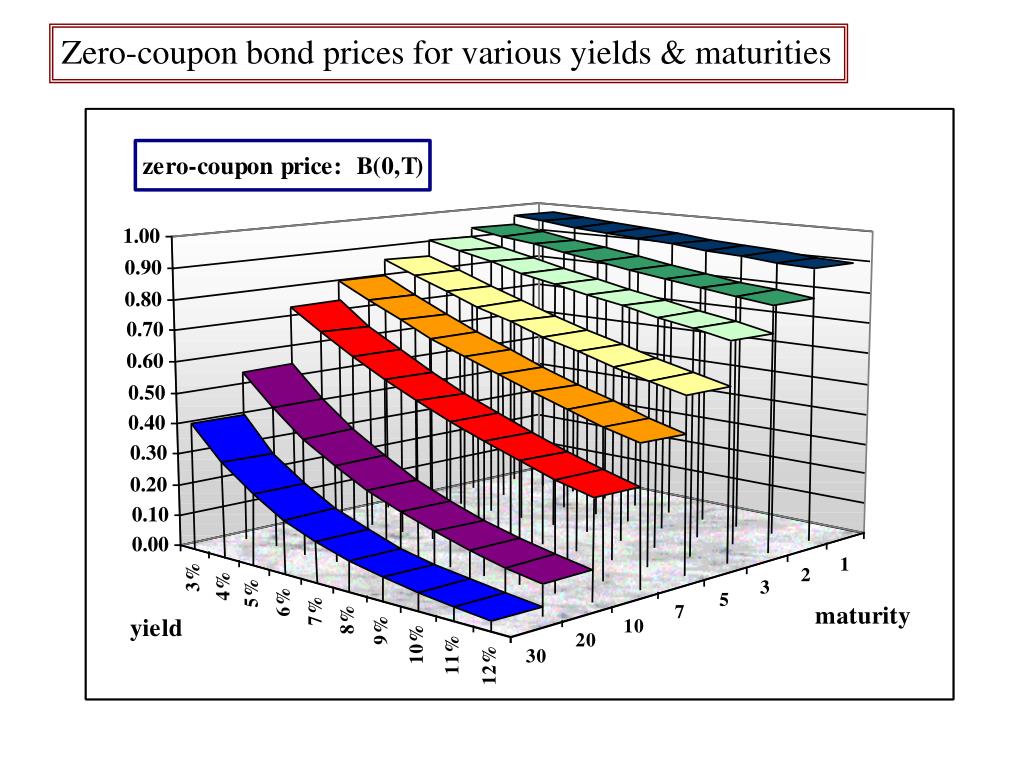

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with dividends reinvested by 500% over the subsequent 30-years as interest rates fell from around 14.6% to around 3%. I started investing in 30 Year zero coupon treasuries. Now, zero coupon bonds don't pay any interest ... Risk-Neutral Pricing Formula for Zero-coupon bonds with Default Risk ... I am looking for the equations or papers showing the risk-neutral pricing for zero-coupon bonds including default risk. I already tried Googling and searching SSRN and Jstor. bond zero-coupon risk-neutral. Share. Improve this question. Follow asked Apr 4, 2020 at 17:02. Jake Freeman Jake Freeman. 158 4 4 ...

Zero-Coupon Bonds: Pros and Cons - Management Study Guide No Reinvestment Risk: Zero-coupon bonds do not have any reinvestment risk. This is because the bond does not pay interest periodically. Hence, investors do not receive any cash flow which they have to reinvest periodically. The annualized rate which they receive on the zero-coupon bond is the same rate at which their money will be automatically ...

Risk of zero coupon bonds

Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... Mr. Tee is looking to purchase a zero-coupon bond that has a face value of $50 and has 5 years till maturity. The interest rate on the bond is 2% and will be compounded annually. ... They are safe investment instruments, and have a lower element of risk involved. Long Dated zero coupon bonds are said to be the most responsive to interest rate ... Advantages and Risks of Zero Coupon Treasury Bonds Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros fall significantly if the Fed raises interest rates. They also ... The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ...

Risk of zero coupon bonds. How to Buy Zero Coupon Bonds | Finance - Zacks The bonds are sold at a deep discount, and the principal plus accrued interest is paid at the bond's maturity date. The less you pay for a zero coupon bond, the higher the yield. A bond with a ... Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ... Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money.It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest. Compound Interest Compound interest is ...

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price or value is the present value of all future cash flows expected from the bond. As the bond has no interest payments, the only cash flow is the face value of the bond received at the maturity date. Zero Coupon Bond Pricing Example. Suppose for example, the business issued 3 year, zero coupon bonds with a face value of ... Zero-Coupon Bond - Definition, How It Works, Formula Zero-coupon bonds are the only type of fixed-income investments that are not subject to investment risk - they do not involve periodic coupon payments. Interest rate risk is the risk that an investor's bond will decline in value due to fluctuations in the interest rate. Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: You must pay tax on interest annually even though you don't receive it until ... Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero-Coupon Bond Definition - Investopedia Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Should I Invest in Zero Coupon Bonds? | The Motley Fool So, for instance, if you spent $750 on a 10-year $1,000 zero coupon bond, then the fact that the bond was priced to yield around 3% would mean that you'd have to pay tax on 3% of its value each ... Zero Coupon Bonds Zero-coupon bond (also known as discount bond or deep discount bond) is a bond issued at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments, or have a "coupon rate," hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par ... Zero Coupon Bond -Features, benefits, drawbacks, taxability, & FAQs Interest Rate Risk: Zero-coupon bonds that are sold before maturity are subject to interest rates risk. This is because the value of these bonds is inversely proportional to interest rates. Hence, if interest rates rise, the value of these bonds declines in the secondary market. Additionally, issuers have the option of redeeming the bond before ...

The Pros and Cons of Zero-Coupon Bonds - Financial Web Zero-coupon bonds are a type of bond that does not pay any regular interest payments to the investor. Instead, you purchase the bond for a discount and then when it matures, you can get back the face value of the bond. ... Another problem with zero coupon bonds is that they have a higher default risk than traditional bonds. The reason behind ...

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww But the Zero Coupon bonds remove the reinvestment risk. Zero Coupon bonds do not allow any periodic coupon payments and thus a fixed interest on Zero Coupon bonds is assured. Fixed returns: The Zero Coupon bond is an ideal choice for those who prefer the long-term investment and earn in a lump sum. The reason behind this is the assurance of a ...

Do zero-coupon bonds have interest rate risk? - Quora Answer (1 of 3): There are two types of interest rate risk: price risk and reinvestment rate risk. Zeros always have exposure to the first type, and MIGHT have exposure to the second type. When people use the term "interest rate risk", they usually refer to the first type of risk (i.w. "price ri...

Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. Investors can purchase zero coupon bonds from places such as the ...

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs ...

Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep Zero-Coupon Bond Price Formula. To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods.

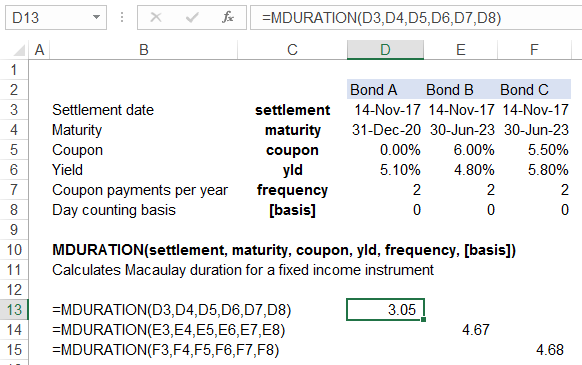

Why do zero coupon bonds have higher interest rate risk than ... - Quora Answer (1 of 5): They say timing is everything! That's certainly true in finance. The answer hinges on the concept of duration. Assume that credit risk can be ignored for a borrower who wants to borrow for 20 years. You can choose between a standard coupon-paying bond that pays interest in equal ...

Investor's Guide to Zero-Coupon Municipal Bonds - Project Invested Zero-coupon bonds are sold at a substantial discount from the face value. For example, a bond with a face value of $20,000, maturing in 20 years with a 5.5% coupon, may be purchased at issuance for roughly $6,757. At the end of the 20-year investment, the investor will receive the full $20,000 face value.

What Are Zero Coupon Bonds And Their Risks- Tavaga | Tavagapedia Risks associated with Zero-Coupon Bonds. As there is no coupon rate, ZCBs are safer as compared to other fixed-income instruments, which are sensitive to changes in interest rates. But ZCBs do possess risk subjected to changes in interest rates if sold before maturity. The value of ZCB and interest rate are inversely related, so an increase in ...

Mapping Zero-coupon Bonds to Risk Factors - Finance Train The first coupon is sensitive to the 6-month interest rate, the next coupon is sensitive to the one-year interest rate, and the last (10th) payment will be sensitive to the 5-year zero-coupon interest rate. For the purpose of mapping each cash flow, the risk manager will need to identify a set of zero-coupon bonds at different maturities.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ...

Advantages and Risks of Zero Coupon Treasury Bonds Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros fall significantly if the Fed raises interest rates. They also ...

Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... Mr. Tee is looking to purchase a zero-coupon bond that has a face value of $50 and has 5 years till maturity. The interest rate on the bond is 2% and will be compounded annually. ... They are safe investment instruments, and have a lower element of risk involved. Long Dated zero coupon bonds are said to be the most responsive to interest rate ...

Post a Comment for "44 risk of zero coupon bonds"