41 find the coupon rate of a bond

AT & T INC.DL-NOTES 2019(19/39) Bond | Markets Insider The AT & T Inc.-Bond has a maturity date of 3/1/2039 and offers a coupon of 4.8500%. The payment of the coupon will take place 2.0 times per biannual on the 01.09.. At the current price of 97.54 ... fixed income - Duration of a floating rate bond - Quantitative … Yes. the duration of a floating rate bond is the time t until the next coupon payment, as your equation shows. The payments that come after are not known yet and will be determined based on interest rates then prevailing, so they carry no duration risk. In general floating rate bonds are what people buy when they want the smallest duration possible. Long term ZCB are what …

Yield to Maturity vs. Coupon Rate: What's the Difference? 20.05.2022 · While the coupon rate of a bond is fixed, the par or face value may change. No matter what price the bond trades for, the interest payments will always be $20 per year. For example, if interest ...

Find the coupon rate of a bond

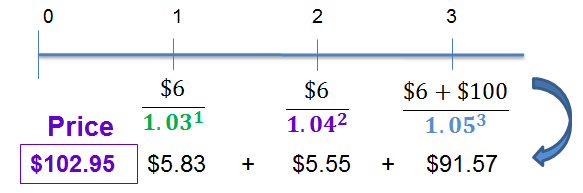

Bond Price Calculator | Formula | Chart 20.06.2022 · To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. Clariant AG: Placed a green bond in the amount of CHF 175 million The CHF 175 million green bond has a coupon of 2.717 % and a 2027 maturity date. ... 2.717 % coupon rate and 2027 maturityProceeds to be used for Eligible Assets driving sustainable innovation as ... How to Invest in Bonds - The Motley Fool For example, you might buy a 10-year, $10,000 bond paying 3% interest. In exchange, your town will promise to pay you interest on that $10,000 every six months and then return your $10,000 after 10...

Find the coupon rate of a bond. Fixed Rate Bonds | Nationwide Fixed Rate Bond Key Product Information. PDF, 75KB (opens in a new window) Our Savings General Terms and Conditions. PDF, 122KB (opens in a new window) Other Important Information. Charitable assignment. Declaration. Withdrawal limits. Savings and ISA help. Useful guides to help you manage your account and understand the different ways to save. Savings … United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 3.098% yield. 10 Years vs 2 Years bond spread is -28.4 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 2.50% (last modification in July 2022). The United States credit rating is AA+, according to Standard & Poor's agency. Zambia Government Bonds - Yields Curve Click on the " Compare " button, for a report with the full comparison between the two countries, with all the available data. Zambia Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield. › finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

P162.7B raised from sale of 5.5-year retail bonds The Bureau of the Treasury (BTr) on Tuesday raised an initial P162.7 billion from the sale of 5.5-year retail treasury bonds (RTBs), the Marcos administration's first foray into borrowing from small creditors like individuals and cooperatives. During the rate-setting auction, the BTr awarded the RTBs at a coupon rate of 5.75 percent a year. UK 10 year Gilt Bond, chart, prices - FT.com - Financial Times Almost half of Europe under drought warning conditions August 22, 2022. The 'insane' state of financial sector climate action August 22, 2022. Global scope of EU's greenwashing crackdown spooks Wall Street August 21, 2022. How a 20-year-old student made $110mn riding the meme stock wave August 21, 2022. The power of capital markets can be ... Kotak Cherry - Direct Mutual Funds, SIP, Investment platform What is bond coupon? Are there any risks involved in investing in Bonds? ... The relationship between interest rates and bond prices is an inverse one. When interest rates increase, bond prices fall and when interest rates fall, bond prices increase. 3 min read . › homeEuropean Central Bank Aug 10, 2022 · Premiums contribute to a deposit insurance fund that lowers taxpayers’ resolution cost of bank failures. We find that risk-adjusted premiums reduce moral hazard, enabling the policymaker to increase deposit insurance coverage by 3 percentage points and decrease the share of expected annual bank failures from 0.66% to 0.16%.

› Zero_Coupon_Bond_ValueZero Coupon Bond Value - Formula (with Calculator) After 5 years, the bond could then be redeemed for the $100 face value. Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining would be $74.73. Current Rates | Edward Jones Zero Coupon Bonds These securities are derived from Government of Canada, Provincial Government, and Corporate bonds. The coupons are removed and sold as different securities. The zero coupon security carries the same backing as the original bond. Market and interest risks are greater with zero coupon securities than with the original bond. FLOT ETF Report: Ratings, Analysis, Quotes, Holdings | ETF.com FLOT tracks an index of investment-grade floating rate corporate bonds with maturities of 0-5 years. These bonds pay a variable coupon rate, the majority of which vary with the 3-month LIBOR. Time To Pay Attention To The Fixed-To-Floating Rate Securities Summary. A significant amount of the Fixed-To-Floating Rate Preferred and Baby Bond securities tied to 3-Month Libor are above initial coupon rate when they float. Recent legislation removes risk ...

Bond Value Calculator: What It Should Be Trading At | Shows Work! Enter the par (face) value of the bond. Step #2: Enter the bond's coupon rate percentage. Step #3: Select the coupon rate compounding interval. Step #4: Enter the current market rate that a similar bond is selling for. Step #5: Enter the number of years until the bond reaches maturity. Step #6: Click the "Calculate Bond Price" button.

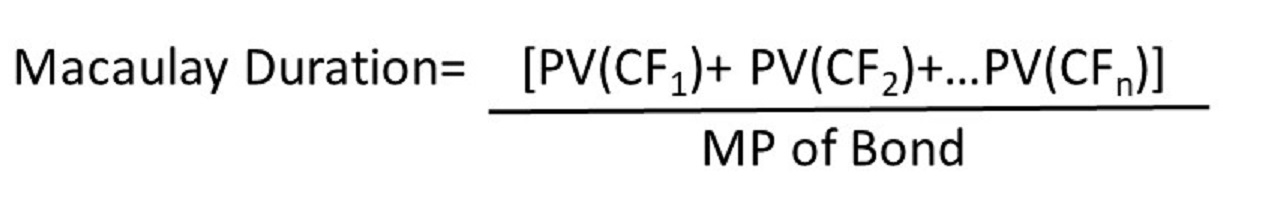

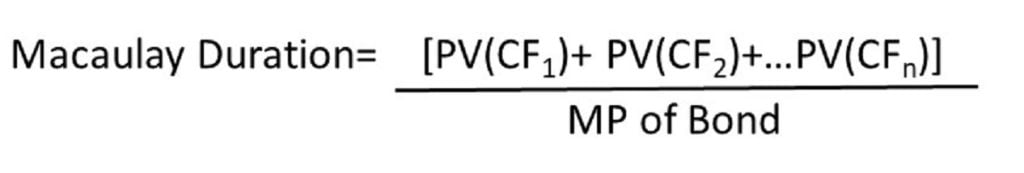

How to Calculate Macaulay Duration in Excel - Investopedia Next, enter "Bond's Maturity Date" into cell A3 and "January 1, 2030" into cell B3. Then, enter "Annual Coupon Rate " into cell A4 and "5%" into B4. In cell A5, enter "Annual Yield to Maturity" and...

How Is the Interest Rate on a Treasury Bond Determined? - Investopedia If an investor purchases that same $10,000 bond for $9,500, then the rate of investment return isn't 5% - it's actually 5.26%. This is calculated by the annual coupon payment ($500) divided by the...

quant.stackexchange.com › questions › 23278fixed income - Duration of a floating rate bond ... Yes. the duration of a floating rate bond is the time t until the next coupon payment, as your equation shows. The payments that come after are not known yet and will be determined based on interest rates then prevailing, so they carry no duration risk. In general floating rate bonds are what people buy when they want the smallest duration ...

Compare Fixed Rate Bonds | MoneySuperMarket Some fixed rate bond accounts can be opened with as little as £1, for example, but typical minimum deposits start at about £500. Maximum deposits can go into millions, but remember only the first £85,000 will be protected by the FSCS (where applicable). You may find the most competitive rates require a larger deposit – although, this isn’t always the case. Once you’ve …

LiveLive Market Watch - Bonds Trade In Capital Market, NSE India Get Live Bonds Trade In Capital Market Data From National Stock Exchange, India. The bonds are traded & settled on Dirty Price i.e. including accrued interest.

NTPC to issue debentures worth ₹2,000 cr on Aug 25 at 7.44% coupon rate Government-owned NTPC will be issuing unsecured non-convertible debentures to the tune of ₹2,000 crore on August 25 via private placement. The bonds will have a coupon rate of 7.44% per annum ...

› bond-basics-417057Bond Basics: Issue Size and Date, Maturity Value, Coupon May 28, 2022 · Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures.

What Are Bond Funds? - fool.com Here are the main types of bond funds you'll find: U.S ... Bonds are an example of a fixed income investment because the coupon rate on an individual bond never changes regardless of other ...

US 10 year Treasury Bond, chart, prices - FT.com Comparisons. Upper. Click on an indicator below to add it to the chart. Lower. Base comparison. Change (1Y) US 10 year Treasury. US10YT. +140.40%.

› bond-valueBond Value Calculator: What It Should Be Trading At | Shows Work! Enter the par (face) value of the bond. Step #2: Enter the bond's coupon rate percentage. Step #3: Select the coupon rate compounding interval. Step #4: Enter the current market rate that a similar bond is selling for. Step #5: Enter the number of years until the bond reaches maturity. Step #6: Click the "Calculate Bond Price" button.

Bond coupons outpace savings rates - The Saigon Times According to FiinGroup, the coupon rates of corporate bonds issued last month ranged from 4.3% to 7.6%, significantly higher than the average interest rate of the first half of this year at just 4.35%. Regarding the property sector, only Ha An Real Estate Trading Investment Joint Stock Company issued bonds with an annual nominal interest rate ...

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ...

Coupon Rate Calculator | Bond Coupon 15.07.2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

Daily Treasury Yield Curve Rates - YCharts Daily Treasury Yield Curve Rates are commonly referred to as "Constant Maturity Treasury" rates, or CMTs. Yields are interpolated by the Treasury from the daily yield curve. ... Japan Government Bonds Interest Rates: Aug 23 2022, 19:30 EDT: Bank of Japan Basic Discount Rate: Aug 23 2022, 19:50 EDT: Euro Short-Term Rate: Aug 24 2022, 02:00 EDT:

(Solved) - a $1000 par value bond has a coupon rate of 8% and a coupon ... a $1000 par value bond has ...

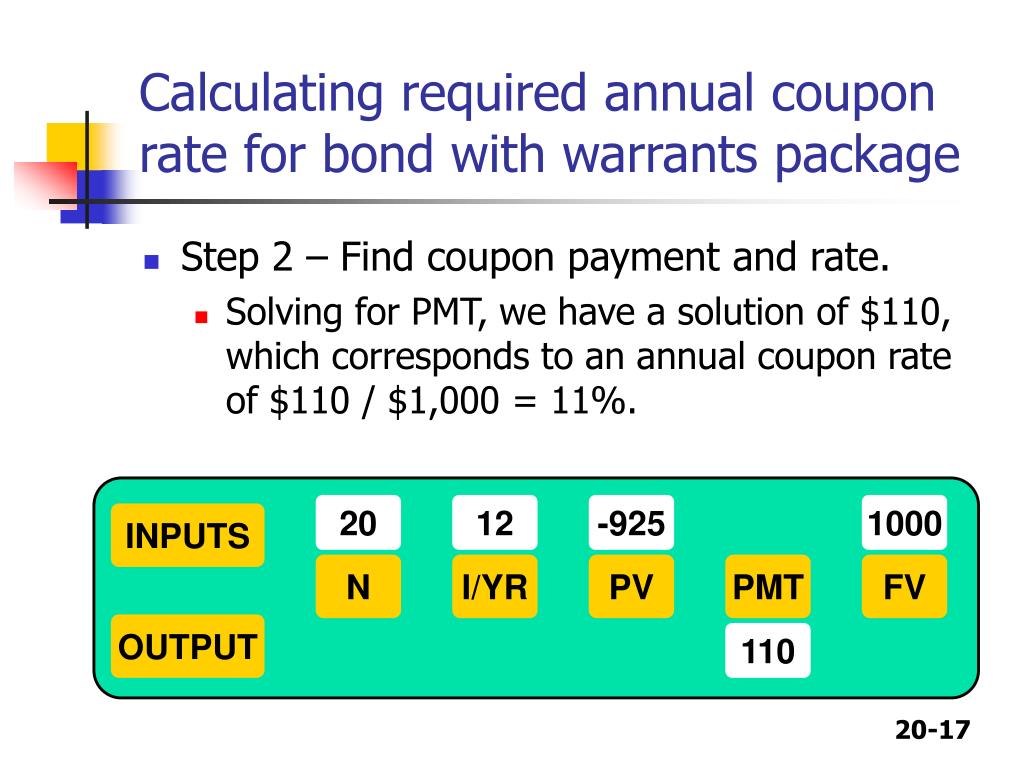

solved:A 20-year, $1,000 par value zero-coupon rate bond is to be A 20-year, $1,000 par value zero-coupon rate bond is to be issuedto yield 7 percent. UseAppendix Bfor an approximate answer but calculate your final answer using the formula and financial calculator methods .a.What should be the initial price of the bond? ( Assume annual compounding.

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "41 find the coupon rate of a bond"