43 zero coupon bond yield calculation

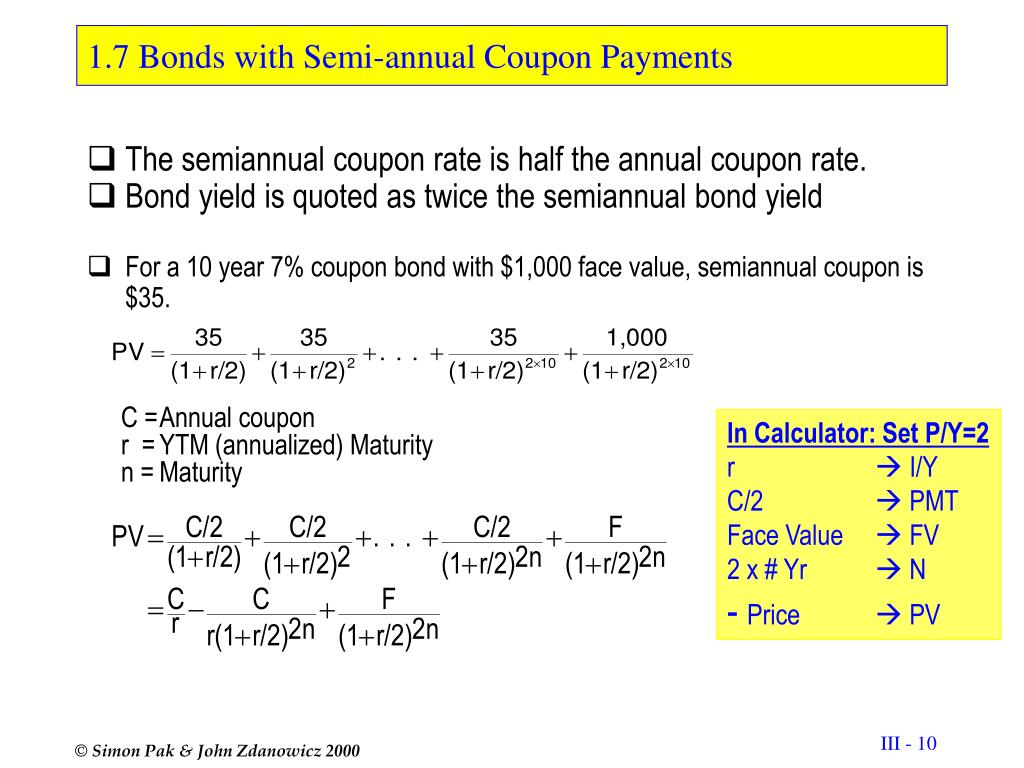

› terms › bWhat Is Bond Yield? - Investopedia May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... dqydj.com › bond-convexity-calculatorBond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

› zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

Zero coupon bond yield calculation

› bootstrapping-yield-curveBootstrapping | How to Construct a Zero Coupon Yield Curve in ... Zero-Coupon Rate for 2 Years = 4.25%. Hence, the zero-coupon discount rate to be used for the 2-year bond will be 4.25%. Conclusion. The bootstrap examples give an insight into how zero rates are calculated for the pricing of bonds and other financial products. One must correctly look at the market conventions for proper calculation of the zero ... › EN › MarketZero Coupon Yield Curve - The Thai Bond Market Association IRR Calculation; Bond Price. Search by Bond; Month-end MTM Prices; ... Bond Market Data; Yield Curve; Zero Coupon Yield Curve; Service Manager : Wat (0-2257-0357 ext ... › knowledge › current-yieldCurrent Yield: Bond Formula and Calculator [Excel Template] Current Yield = Annual Coupon ÷ Bond Price; For instance, if a corporate bond. Current Yield = $80 Annual Coupon ÷ $970 Bond Price; Current Yield = 8.25%; Current Yield of Discount, Par & Premium Bonds. The difference between the current yield and coupon rate of a bond stems from the pricing of the bond diverging from its par value.

Zero coupon bond yield calculation. calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. › knowledge › current-yieldCurrent Yield: Bond Formula and Calculator [Excel Template] Current Yield = Annual Coupon ÷ Bond Price; For instance, if a corporate bond. Current Yield = $80 Annual Coupon ÷ $970 Bond Price; Current Yield = 8.25%; Current Yield of Discount, Par & Premium Bonds. The difference between the current yield and coupon rate of a bond stems from the pricing of the bond diverging from its par value. › EN › MarketZero Coupon Yield Curve - The Thai Bond Market Association IRR Calculation; Bond Price. Search by Bond; Month-end MTM Prices; ... Bond Market Data; Yield Curve; Zero Coupon Yield Curve; Service Manager : Wat (0-2257-0357 ext ... › bootstrapping-yield-curveBootstrapping | How to Construct a Zero Coupon Yield Curve in ... Zero-Coupon Rate for 2 Years = 4.25%. Hence, the zero-coupon discount rate to be used for the 2-year bond will be 4.25%. Conclusion. The bootstrap examples give an insight into how zero rates are calculated for the pricing of bonds and other financial products. One must correctly look at the market conventions for proper calculation of the zero ...

:max_bytes(150000):strip_icc()/dotdash_INV_final_Discount_Yield_Jan_2021-01-fc704294a32348a7bc00e0fc7652b88e.jpg)

Post a Comment for "43 zero coupon bond yield calculation"