42 how to calculate coupon rate from yield

Coupon Rate - Explained - The Business Professor, LLC To calculate the coupon rate, you first have to divide the sum of the security's yearly coupon payment. You then divide them by the par value of the bond. Example of Coupon Rate Lets assume that Eddie has a 10-year bond of ABC Company with $10,000 as the nominal value and a maturity period of 20 years. The interest rate is 8% per year. How do I Calculate Zero Coupon Bond Yield? - Smart Capital Mind The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ...

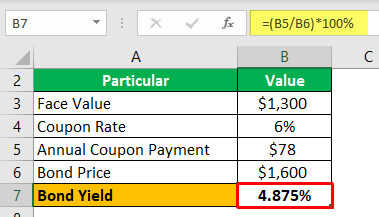

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia In general, a bond's coupon rate will be comparable with prevailing interest rates when it is first issued. How Do You Calculate Yield Rate? A bond's yield, or coupon rate, is computed by dividing...

How to calculate coupon rate from yield

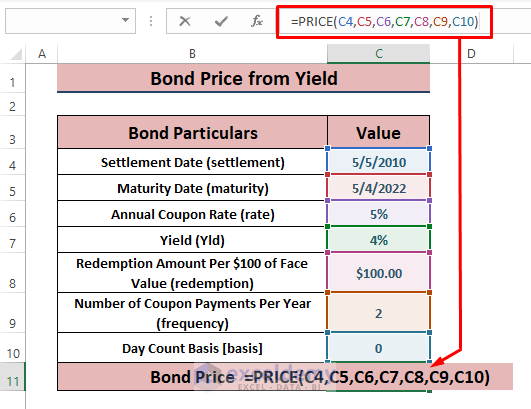

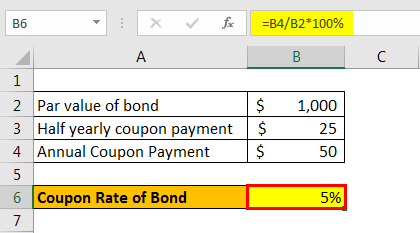

Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. How To Find Coupon Rate Of A Bond On Financial Calculator Once you have this information, you can follow these steps to calculate the coupon rate: 1) Enter the face value of the bond into the calculator. 2) Enter the coupon rate into the calculator. 3) Enter the number of years until the bond matures into the calculator. 4) Enter the market interest rate into the calculator. Calculating The Yield Of A Coupon Bond Using Excel An example of the yield of a coupon bond: so let's walk through an example to make it a little bit easier for you to understand. so let's say that you bought a five year bond with a coupon rate of. To calculate the current yield of a bond in microsoft excel, enter the bond value, the coupon rate, and the bond price into adjacent cells (e.g., a1 ...

How to calculate coupon rate from yield. What Is Coupon Rate And How Do You Calculate It Personal Accounting A coupon rate is the yield paid by a fixed revenue safety; a fixed income safety's coupon price is simply just the annual coupon funds paid by the issuer relative to the bond's face or par value. the coupon rate, or coupon payment, is the yield the bond paid on its concern date. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). If the price of the bond falls to $800, then the yield-to-maturity will change from 2% to 2.5% ( i.e., $20/$800= 2.5%). The yield-to-maturity only equals the coupon rate when the bond sells at face value. Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for... Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Corporate Bond Valuation - Overview, How To Value And Calculate Yield To calculate the yield, set the bond's price equal to the promised payments of the bond (coupon payments), divide it by one plus a rate, and solve for the rate. The rate will be the yield. An alternative way to solve a bond's yield is by using the "Rate" function in Excel. EOF Coupon Rate Calculator | Solution Step by Step 🥇 The coupon rate is the yield that a bond pays annually. The coupon rate is calculated as the sum of all periodic interest payments made on a bond divided by the face value of that bond. The coupon rate will typically be lower than the stated interest rate, which is also referred to as a nominal interest rate or nominal yield.

Where to find yield to maturity? Explained by FAQ Blog This yield changes as the value of the bond changes, thus giving the bond's yield to maturity (YTM). A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. How do you calculate yield to maturity on a financial calculator? Effective Yield - Overview, Formula, Example, and Bond Equivalent Yield Effective Yield = [1 + (i/n)] n - 1 Where: i - The nominal interest rate on the bond n - The number of coupon payments received in each year Practical Example Assume that you purchase a bond with a nominal coupon rate of 7%. Coupon payments are received, as is common with many bonds, twice a year. Coupon Rate Formula & Calculation - Study.com To calculate the coupon rate of ABZ, the steps discussed in the coupon rate formula should be followed. Identify the par value of the bond: In this example, ABZ is issuing bonds with a $1,000 par ... How to Calculate Current Yield (Formula and Examples) Coupon rate = (total annual coupon payment / par value of bond) x 100. Example: A bond with a face value of $200 and a $5 coupon has a coupon rate of 2.5% because ($5 / $200) x 100 = 2.5%. Nominal yield vs. yield to maturity. Nominal yield is another name for the coupon rate. The yield to maturity is the total return you earn if you hold the ...

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

How do you calculate the coupon rate of a bond? Coupon rate is calculated by adding up the total amount of annual payments made by a bond, then dividing that by the face value (or "par value") of the bond. What is the coupon rate of the bond? The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond.

Calculating The Yield Of A Coupon Bond Using Excel An example of the yield of a coupon bond: so let's walk through an example to make it a little bit easier for you to understand. so let's say that you bought a five year bond with a coupon rate of. To calculate the current yield of a bond in microsoft excel, enter the bond value, the coupon rate, and the bond price into adjacent cells (e.g., a1 ...

How To Find Coupon Rate Of A Bond On Financial Calculator Once you have this information, you can follow these steps to calculate the coupon rate: 1) Enter the face value of the bond into the calculator. 2) Enter the coupon rate into the calculator. 3) Enter the number of years until the bond matures into the calculator. 4) Enter the market interest rate into the calculator.

Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders.

/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "42 how to calculate coupon rate from yield"