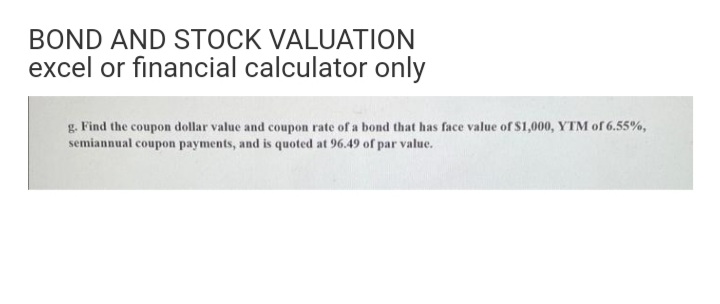

38 how to find the coupon rate of a bond

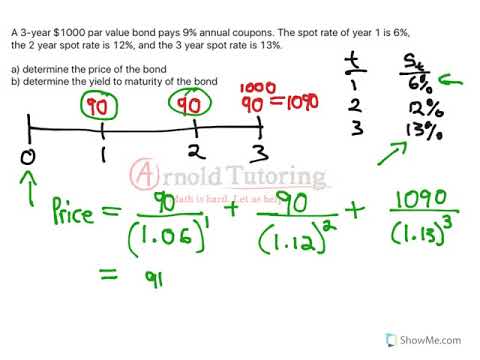

Coupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. How To Find Coupon Rate Of A Bond On Financial Calculator Aug 05, 2022 · To calculate the coupon rate on a financial calculator, enter the face value of the bond and then press the ‘Coupon’ or ‘CP’ button. This will bring up a list of different coupon rates. Find the coupon rate that matches the interest rate on your bond and press enter. The COUP function will then calculate the coupon rate for you. Formula: C=PZ ^ k

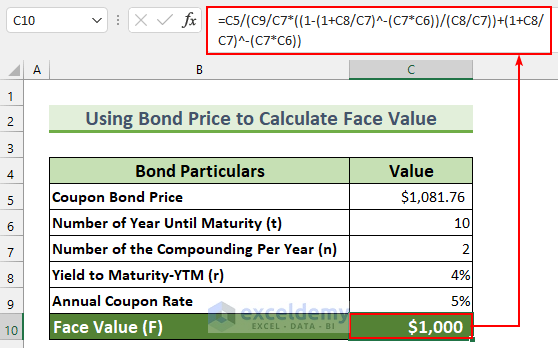

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond’s par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link

How to find the coupon rate of a bond

How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia Most bonds have a clearly stated coupon rate, which is expressed as a percentage. However, calculating the coupon rate using Microsoft Excel is simple if all you have is the coupon payment amount and the par value of the bond. What Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · The formula to calculate a bond’s coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let’s say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate.

How to find the coupon rate of a bond. What Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · The formula to calculate a bond’s coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let’s say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia Most bonds have a clearly stated coupon rate, which is expressed as a percentage. However, calculating the coupon rate using Microsoft Excel is simple if all you have is the coupon payment amount and the par value of the bond.

Post a Comment for "38 how to find the coupon rate of a bond"